I-20 Financial Requirements and Estimated Expenses

The amounts found below are estimates for I-20 purposes. Actual amounts may vary based on academic program specific fees and living preferences. The estimated costs of attendance will be updated as they become available. Funding amounts are specified for each academic program. Read on to learn more about the financial requirements, financial sponsor form, and find the estimated expenses for your program. Be sure to check out our financial FAQ for more information!

Our office is currently processing I-20 requests for programs that begin in Summer and Fall 2025.

|

Financial Requirements

Please review this information for financial document requirements and the financial sponsor form.

If you have any questions please refer to our FAQ below.

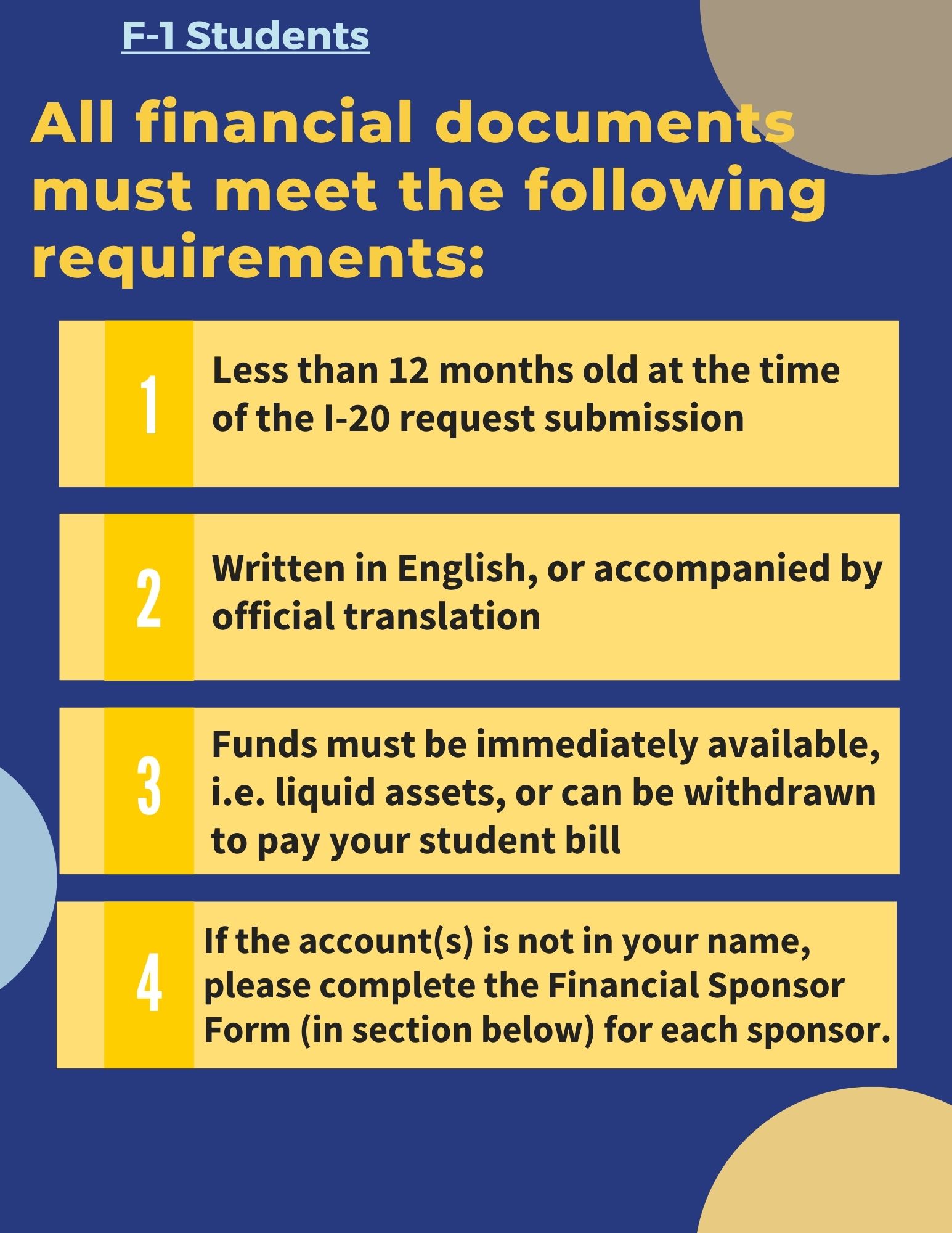

All financial documents must meet the following requirements:

- Less than 12 months old at the time of the I-20 or DS-2019 Request submission

- Written in English, or accompanied by official translation

- Funds must be immediately available, i.e. liquid assets, or can be withdrawn to pay your student bill

- If the account(s) is not in your name, please complete the Financial Sponsor Form (in section below) for each sponsor.

- Financial documents must be the source of funds that are intended for your academic use at Emory. If your funding source changes after the I-20/DS-2019 is issued, you must contact ISSS.

Acceptable types of financial documents:

| Type of Document | Document Requirements |

| Bank letters/statements |

|

| Emory University funding or scholarship award letter / email |

|

| Approved or pre-approved education loan letter |

|

| Government financial guarantee |

|

| Provident Account |

|

| Company/Corporate sponsorship letter |

|

The following documents are not acceptable:

| Real estate |

| Trust fund accounts |

| Salary statements |

| Credit card statements |

| Stocks and bonds |

| Business bank accounts |

| Retirement fund |

| Mutual Funds |

Financial Sponsor Form

This form is required of all F-1 students who have a financial sponsor. A sponsor If you have more than one sponsor, each sponsor will fill out and sign this form. This form should accompany the acceptable financial document(s) in the sponsor’s name. Please upload the form(s) to the I-20 Request e-form.

Estimated Expenses

The estimated costs of attendance will be updated as they become available. Funding amounts are specified for each academic program. The amounts found below are estimates for I-20 purposes only. Actual amounts may vary based on academic program specific fees and living preferences.

Our office is currently processing I-20 requests for programs that begin in Summer/Fall 2025. Funding amounts will be updated periodically, so please check back if your program's section is blank.

Jump directly to your program by clicking the name of your school:

- Candler School of Theology

- Emory College and Oxford College

- Goizueta Business School

- Laney Graduate School (LGS)

- Rollins School of Public Health

- School of Law

- School of Medicine

- Nell Hodgson Woodruff School of Nursing

Note: Not all of Emory's programs are eligible for an I-20. If you do not see your program listed below, please email ISSS as soon as possible for clarification.

Candler School of Theology

F-1 Degree Seeking Students Only

Note I-20s are not available for MRL and MRPL students. For MDiv students, I-20s are only available for fully in-person students. Hybrid and online students are not eligible for an immigration document from Emory.

| Master of Divinity (Fall 25 Starting Semester) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $27,550 |

| Living Expenses (9 months) |

$21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,500 |

| Total: $55,376 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| Master of Theology (MT) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $27,550 |

| Living Expenses (9 months) |

$21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,500 |

| Total: $55,376 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| Master of Theological Studies (MTS) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $27,550 |

| Living Expenses (9 months) |

$21,312 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,500 |

| Total: $55,376 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

Emory College and Oxford College

F-1 Degree Seeking Students Only

| Emory College and Oxford Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $62,294 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $4,002 |

| Total: $87,622 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

Goizueta Business School

F-1 Degree Seeking Students Only

| MF Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | $77,642 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $10,026 |

| Total: $108,994 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MBA (2 Year) Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | $76,200 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $11,220 |

| Total: $108,746 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MBA (1 Year) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $114,300 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $14,770 |

| Total: $157,504 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MSBA Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $82,560 |

| Living Expenses (10 months) | $23,690 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $9,319 |

| Total: $115,569 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| BBA Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $62,294 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $4,002 |

| Total: $87,622 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,20 |

| Master in Management (MiM) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $64,300 |

| Living Expenses (12 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,966 |

| Total: $94,592 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MBA + MSBA Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $110,850 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $145,284 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

Laney Graduate School (LGS)

F-1 Degree Seeking Students Only

| PhD Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $73,725 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $108,159 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MA/MS Estimated Expenses (see below- certain specific Master's programs) | AY 2025-26 |

| Tuition and Fees | $49,150 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $76,476 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

|

MS Economics Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | $73,725 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $108,159 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

|

MDP Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | $73,725 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $108,159 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

Rollins School of Public Health

F-1 Degree Seeking Students Only

| MPH/MSPH Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $42,395 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,854 |

| Total: $72,575 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| Accelerated MPH Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $59,218 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,954 |

| Total: $96,606 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

School of Law

F-1 Degree Seeking Students Only

| JD Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $67,480 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $9,270 |

| Total: $98,076 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| SJD Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $67,480 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $9,270 |

| Total: $98,076 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| LLM (Fall 2025 Starting Semester) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $67,480 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $9,270 |

| Total:$98,076 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| LLM (Spring 2026 Starting Semester) Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | n/a |

| Living Expenses (9 months) | n/a |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | n/a |

| Total: n/a | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

| MCL (Spring 2026 Starting Semester) Estimated Expenses |

AY 2025-26 |

| Tuition and Fees | n/a |

| Living Expenses (6 months) | n/a |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | n/a |

| Total: n/a | |

| Dependent Expenses (if applicable, add to total) | |

| F-2/J-2 Spouse | $8,400 |

| F-2/J-2 Child (per child) | $4,200 |

School of Medicine

F-1 Degree Seeking Students Only

| MD and MD/PhD Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $57,070 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $11,810 |

| Total: $97,314 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

| MMSc (GensCns) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $50,000 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,000 |

| Total: $84,434 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

| MMSc (PA) Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $49,828 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,862 |

| Total: $87,124 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

| DPT Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $40,800 |

| Living Expenses | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $11,000 |

| Total: $80,234 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

Nell Hodgson Woodruff School of Nursing

F-1 Degree Seeking Students Only

| MN (Fall 2025 Starting Semester)Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $82,204 |

| Living Expenses (12 months) | $28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,900 |

| Total: $119,538 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

| MN (Spring 2026 Starting Semester)Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $82,204 |

| Living Expenses (12 months) |

$28,434 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $8,900 |

| Total: $119,538 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

| BSN Estimated Expenses | AY 2025-26 |

| Tuition and Fees | $69,276 |

| Living Expenses (9 months) | $21,326 |

| Other Expenses (includes health insurance, books & supplies, miscellaneous expenses) | $6,500 |

| Total: $97,102 | |

| Dependent Expenses (if applicable, add to total) | |

| F-2 Spouse | $8,400 |

| F-2 Child (per child) | $4,200 |

Financial FAQ

Note: Check out our webinar to hear a live explanation about financial documents and funding.

General Questions

- What are the requirements for financial documents?

- What are acceptable financial documents?

- What are unacceptable financial documents?

- How old can my financial documents be?

- How long do I have to show funding for?

- I have shown more funding than required, why isn’t it reflected on my I-20?

- My cost of living might be less than what’s on the website because I am living with someone. Can my required funding be adjusted?

- My Financial circumstances have changed. Do my I-20 need to be updated?

Financial Sponsor Form

- Who needs to submit the financial sponsor form?

- What type of documentation is required from my sponsor?

- My sponsor has changed from one family member to another, do I need to update my I-20?

- I have lost my financial sponsor and no longer have sufficient funds, can I still be issued an I-20?

School Related

- I received the REAL Scholarship (Rollins students only), why does it not count towards my funding?

- The required amount on my program’s website is different than on your website. Which amount do I need to show funding for?

General FAQ

What are the requirements for financial documents?

All financial documents must meet the following criteria:

- Less than 12 months old at the time of the I-20 Request submission

- Written in English, or accompanied by official translation

- Funds must be available immediately, i.e. liquid assets, or can be withdrawn to pay your student bill.

- If the account(s) is not in your name, you must complete the Financial Sponsor Form for each sponsor.

- Must include either the student or sponsor’s name

- Financial documents must be the source of funds that are intended for your academic use at Emory. If your funding source changes after the I-20/DS-2019 is issued, you must contact ISSS.

Note: There may be additional requirements depending on the specific document. Please check here to read more.

What are acceptable financial documents

Acceptable financial statements can be any combination of the following documents:

- Bank letters/statements (ex: checking, savings, current, money market, fixed deposit/fixed termtime deposits)

- Emory University funding or scholarship award letter/email

- Approved or pre-approved education loan letter, Government financial guarantee

- Provident Account

- Company/Corporate sponsorship letter

What are unacceptable financial documents?

We cannot accept financial documents that exclusively show non-liquid funds (i.e. funds that are not immediately available). Examples of these documents are:

- Real estate

- Trust fund accounts

- Salary statements

- Credit card statements

- Stocks and bonds

- Business bank accounts

- Retirement fund.

Note: Documents must have an official English translation if they are written in a different language.

How old can my financial documents be?

All financial documents must be less than 12 months old at the time of the I-20 Request submission.

How long do I have to show funding for?

Funding amounts are specified for each academic program. The amounts found above are estimates for I-20 purposes. Actual amounts may vary based on academic program specific fees and living preferences.

F-1 students only need to show enough funding for one academic year at the time of your visa interview.

I have shown more funding than required, why isn’t it reflected on my I-20?

The amounts listed will always equal your total estimated expenses for one academic year. Anything additional is not necessary to declare on your I-20.

My cost of living might be less than what’s on the website because I am living with someone. Can my required funding be adjusted?

Unfortunately, we cannot make any exceptions to the funding amounts that you are required to show. We have consistent funding requirements for all students to ensure fairness.

My financial circumstances have changed. Do I need to update my I-20?

Please send an email to newfjstudent@emory.edu if your financial circumstances change. Your ISSS Advisor will determine how to proceed so that the financial documentation on your I-20 remains accurae.

Financial Sponsor

Who needs to submit the financial sponsor form?

Friends and or family are required to submit the financial sponsor form in addition to their bank statements. Companies and organizations do not need to submit the financial sponsor form in addition to their sponsorship letter.

What type of documentation is required from my sponsor?

Your sponsor is required to provide you with two things:

- Financial sponsor form: If you have more than one sponsor, each sponsor will fill out and sign this form. This form should accompany the acceptable financial document(s) in the sponsor’s name. Please upload the form(s) to the I-20 Request e-form.

2. An acceptable form of financial documentation that meets the requirements listed above.

Note: If your financial sponsor submits their company’s bank statement as documentation, and their name is not listed on the statement, they will need to indicate on the financial sponsor form that have access to those funds.

My sponsor has changed from one family member to another, do I need to update my I-20?

It depends. If your sponsor is changing from one family member to another, but the funding amount is the same, then an update is not necessary. However, if the amount of funding changes then it may be necessary to update the actual amount on your I-20.

Please send an email to newfjstudent@emory.edu if your sponsors change, and we will assess if an update is needed.

I have lost my financial sponsor and no longer have sufficient funds; can I still be issued an I-20?

Unfortunately, we cannot issue an I-20 if you do not have sufficient funding at the time of your request.

School Related

I received the REAL Scholarship (Rollins students only), why does it not count towards my funding?

The money from the REAL Program is not guaranteed because a student must also find a job after coming to Atlanta in order to receive it. In other words, eligibility alone does not guarantee receiving funds due to a variety of external factors. It is in the student's best interest to ensure that they can sufficiently support themselves before arriving at Emory without relying on the REAL scholarship.

The required amount on my program’s website is different than on your website. Which amount do I need to show funding for?

Please show funding for the cost that we have listed on our website, and not your academic program’s website. Our office works with each school to determine what the total cost of each program will be for one academic year. The cost of tuition and fees should not be different; however, it is possible that the cost of living is calculated differently. The estimated cost of living that our office provides is the lowest reasonable cost that one might pay around Emory.

Do you have I-20 questions?

- For initial I-20 questions, contact newfjstudent@emory.edu. For other immigration questions, contact your ISSS advisor.

- Check out our I-20 FAQ page.